Buying your first home is an exciting — but also daunting — process. A down payment on a new home is usually a first-time buyer’s biggest financial investment to date, and in many cases they want to consider all of their options for paying it — even using 401(k) retirement funds.

But can you really use your 401(k) to pay for a home? And if it is allowed, should you do it?

The truth is that it’s a bit of a complex topic. In the sections that follow, we’ll walk you through it to cover:

- Whether 401(k) funds are allowed to be put toward a home (spoiler: yes)

- Options for taking money from your 401(k) account

- Pros and cons of using 401(k) funds to make a down payment on your home

- How it stacks up to other traditional home loan options

Let’s dive in!

Quick Takeaways

- Buyers can access funds from their 401(k) through a loan or an outright withdrawal.

- Outright withdrawals from 401(k) funds incur significant penalty and tax expenses.

- First-time home buyers often consider using 401(k) funds to buy a home when they don’t have enough savings for a traditional down payment.

- Most financial experts advise against using 401(k) funds to pay for a home.

- There are flexible home loan options (like FHA and other first-time buyer programs) that enable people to buy homes with very low down payment requirements.

Can first time home buyers use their 401(k) to buy a home?

The short answer: yes. You can use your 401(k) to make a down payment on your first home. While 401(k)s are designed specifically to encourage saving for retirement, it is your money, and you can access it at any time.

There are two primary ways people access 401(k) funds to put toward a home:

401(k) Loan

When you take out a loan from your 401(k) account, it works like any other loan with some specific parameters.

Most 401(k) plan providers require that borrowers pay the loan back within five years. You’ll also have to pay the loan back with interest, although the obvious benefit is that you will pay it back to yourself.

Going the loan route will also avoid the 10% early withdrawal penalty (given to anyone who withdraws funds before age 59½). It also won’t impact your credit report or your debt-to-income ratio, both significant benefits for people with low credit or who don’t want their credit affected for other reasons.

The maximum amount you can borrow from your 401(k) is $50,000 or half of your current vested interest (whichever is lower).

While this may all sound ideal, there are some drawbacks. Taking out a loan from your 401(k) typically freezes the account — you can’t make additional contributions during the life of your loan, and employers can’t contribute, either. While you pay your loan back, you’ll miss out on growth opportunities for your retirement fund.

The other drawback is that after the five-year term, unpaid funds are considered an outright withdrawal, which incurs income tax and other financial penalties.

401(k) Withdrawal

The other (less desirable) option is to take an outright withdrawal from your 401(k) fund. The reason it’s such an undesirable option is that you’ll automatically pay a 10% penalty on the funds you withdraw and you’ll pay income tax on top of it. That said, you don’t have to pay back the funds you withdraw. In certain circumstances, people may feel that this benefit outweighs the other financial penalties incurred.

There’s also no limit to the amount you can withdraw from your account. You can take out as much money as you want as long as it’s equal or lower than your vested interest.

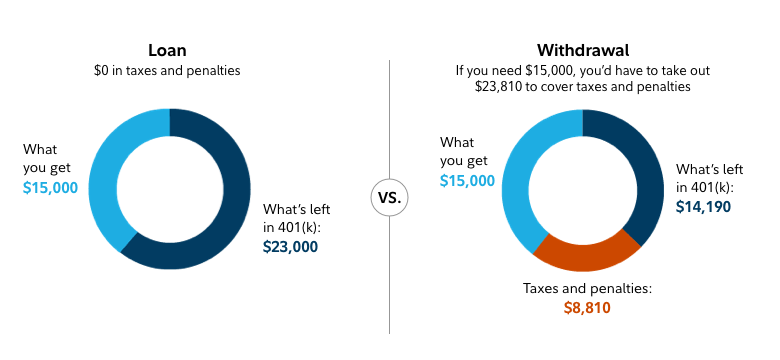

In the example below, you can see the difference between taking out a 401(k) loan vs. an outright withdrawal from an account with a starting balance of $38,000.

Why would someone want to use their 401(k) to buy a home?

There are several reasons a first time home buyer may consider using 401(k) funds to pay for a new home. Typically, it’s done to meet an immediate cash need in order to make the down payment on a home — for instance, when a first-time home buyer doesn’t have savings for a down payment but wants to take advantage of low mortgage interest rates.

Home buyers might be attracted to the low interest rate on 401(k) loans vs. other down payment loan options. Many first time home buyers are also young, so a hit to their retirement savings may not feel like such a big deal.

But the truth is that even when you’re young, removing funds from your retirement account can significantly hurt your growth potential and lower the total amount you’ll save for retirement in the end.

Almost any financial advisor will tell you that it should never be your first option, and many will tell you not to do it under any circumstances.

Is it a good idea to use a 401(k) loan to buy your first home?

As you’ve probably gathered, the short answer to this question is no. Whether you choose to take out a 401(k) loan or outright withdrawal, there are negative financial consequences in the form of either penalties paid or lost growth on your retirement fund.

A better alternative is to take advantage of first-time homebuyer programs that offer low down payment programs and even down payment assistance in some cases. We’ve curated a list of first-time homebuyer programs here in Ohio in this article. If you live in another state, a quick Google for “first time home buyer programs” and your state will give you a list of good options.

There are also general home buyer loan programs like FHA that only require a 3.5% down and are often approved for people with less-than-stellar credit scores. Below is a complete guide to 2022 FHA requirements:

The Ultimate Takeaway

First time homebuyers can use their 401(k)s to buy a home, and there are even attractive benefits to doing so. But the smartest financial decision is to leave your 401(k) for retirement.

Instead, look into other financial options designed for home buying that can offer you equal (if not more) flexibility and convenience.

Looking for a home near Dayton?

If you’re moving to the Dayton area, the team at Oberer Homes can help you find (or build!) your dream home. Contact us today to get started!

Share this Post