Are you looking to buy a house in Dayton, Ohio? If you are, one of the things probably top of mind for you is your budget and the home price you’ll be able to afford. Knowing your financial situation and making smart decisions about spending is one of the most critical responsibilities that come with homeownership.

In this article, we’ll walk you through:

- Understanding the down payment, mortgage payment, and full home price you can afford

- The housing market landscape looks like in Dayton, Ohio right now

- What you can expect to pay for a new house in various Dayton neighborhoods and suburbs

Let’s get started!

Quick Takeaways

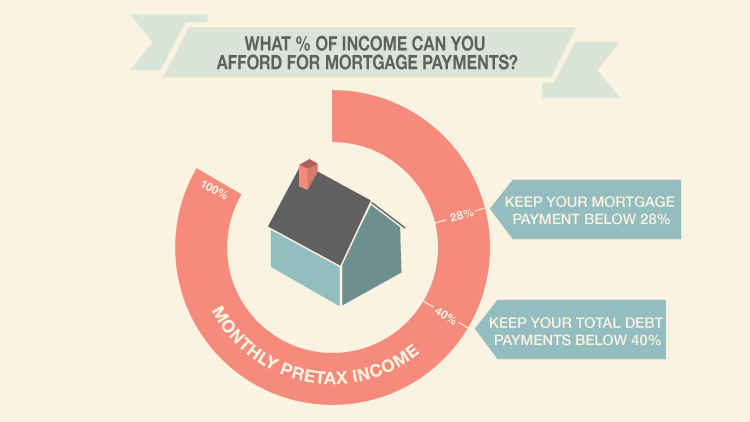

- One homebuyer rule of thumb is to never let your mortgage payment exceed 28% of your monthly income.

- Your down payment dictates the total home price you are able to afford.

- Median home price in Dayton is $115,000 and homes are staying on the market for about one month.

How to figure out your new home budget

The first step to knowing how much money you need to buy a house — anywhere — is actually figuring out how much you can afford.

A good place to start is with the 28% rule. It’s a rule of thumb that says your mortgage payment should not account for more than 28% of your monthly income. This isn’t only a practical rule, either — it’s the maximum many lenders will allow. A great credit score might get you approved for a slightly higher ratio, but we still say it’s good practice to stick with 28% or less.

Next, consider the amount you have saved for a down payment. A conventional mortgage will want you to put down 20% of your home’s full price as a down payment. FHA loans allow for a much lower percentage of 10% or even 3.5% for borrowers with good credit.

Depending on the type of mortgage you qualify for and decide to take out, your down payment planning will vary, but the amount you can put down really dictates the full home price you are able to afford.

Remember, too, that your mortgage is not the only expense involved in homeownership. Taxes, homeowners insurances, repairs, maintenance — these can all add up and it’s important to be prepared to fit them into your budget. Your lender and real estate agent should both be able to guide you through the exact financial responsibilities involved with a home you’re considering.

So, in summary, to determine your new home budget:

- Calculate 28% of your monthly income. That should be your maximum monthly mortgage payment.

- Know how much you’re able to put down for a down payment and the percentage down your mortgage lender will require.

- Research all additional financial responsibilities that come with a new home and build them into your budget.

The housing market in Dayton

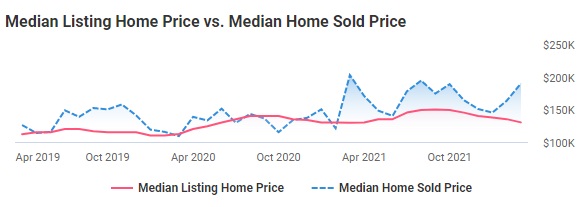

Like it is in cities across the country, home prices in Dayton are on an upward trajectory. The median sale price for a home in the city of Dayton as of February 2022 was $130,000 and the median home sale price was $189,500. Homes are staying on the market for about 45 days.

The good news is that Dayton has a very reasonable cost of living and is considered to be the most affordable of Ohio’s four major metro areas. There are new home options for individuals and families at all income levels. Home prices in Dayton vary quite a bit depending on the neighborhood you choose and whether you’re buying in Dayton proper or one of its desirable surrounding suburbs.

How much money do you need to buy a house in Dayton?

Let’s look at some of Dayton’s most popular neighborhoods and suburbs to determine how much it would cost to buy a house in each of these areas.

*Median home prices sourced from realtor.com. Estimated mortgage payments calculated with Bankrate Mortgage Calculator. All are estimates.

Downtown Dayton

Downtown is the business hub of Dayton, full of young professionals on the go and the restaurants, bars, and coffee shops where they spend their spare time. It’s also the center of Dayton’s nightlife scene. While Downtown Dayton features tall buildings and a big-city feel, it also has urban parks and a beautiful river corridor with green space and water views to balance it out.

Median home price: $237,000

Amount needed to put 20% down: $47,400

Amount needed to put 10% down: $23,700

Estimated monthly mortgage payment with 20% down: $1,178

Estimated monthly mortgage payment with 10% down: $1,297

South Park

Located just south of Downtown and north of University Park, South Park offers easy commutes to the city’s two busiest corporate hubs. It’s a great option for homebuyers looking to for a neighborhood-y feel without being too far away from the Downtown hustle and bustle. Homes in South Park are known for their unique colors and architecture.

Median home price: $139,900

Amount needed to put 20% down: $27,980

Amount needed to put 10% down: $13,900

Estimated monthly mortgage payment with 20% down: $722

Estimated monthly mortgage payment with 10% down: $792

Patterson Park

Patterson Park sits on the Southeast edge of Dayton, a perfect spot for those looking for a more suburban environment while staying inside Dayton proper. With more green space between homes and less hustle and bustle than neighborhoods closer to Downtown, Patterson Park has a laid-back atmosphere that makes it an attractive option for all buyers.

Median home price: $240,000

Amount needed to put 20% down: $48,000

Amount needed to put 10% down: $24,000

Estimated monthly mortgage payment with 20% down: $1,192

Estimated monthly mortgage payment with 10% down: $1,313

Oakwood

Oakwood is well known for its quiet suburban living and top-rated school districts. This, together with its close proximity to Dayton metro (it’s located just south of the city) make it a popular choice. Niche recently named Oakwood the #1 place to live in Ohio!

Median home price: $265,000

Amount needed to put 20% down: $53,000

Amount needed to put 10% down: $26,500

Estimated monthly mortgage payment with 20% down: $1,309

Estimated monthly mortgage payment with 10% down: $1,442

Centerville

Centerville is a larger suburb just south of Dayton. It has both one of the top school districts in the region and one of the best ratings for places to retire in Ohio, making it a popular choice for young families and retirees alike. Centerville features tree-lined residential neighborhoods and a bustling, walkable Uptown, where you’ll find more than 100 small businesses and some of the area’s most historic buildings and sites. It’s a quick 15-minute commute to Downtown Dayton.

Median home price: $250,000

Amount needed to put 20% down: $50,000

Amount needed to put 10% down: $25,000

Estimated monthly mortgage payment with 20% down: $1,239

Estimated monthly mortgage payment with 10% down: $1,365

Beavercreek

Beavercreek is located just east of the city bounds. While it’s already the second-largest suburb of Dayton, it has a large amount of undeveloped land that indicates the area will continue to grow. It features more spread-out neighborhoods with 20+ parks, playgrounds, and other common green spaces. The Green Towne Center is a retail hub where residents can live, shop, dine, and enjoy the community atmosphere.

Median home price: $269,900

Amount needed to put 20% down: $53,980

Amount needed to put 10% down: $26,990

Estimated monthly mortgage payment with 20% down: $1,332

Estimated monthly mortgage payment with 10% down: $1,469

Bellbrook

Bellbrook is a smaller suburb with a population around 7,000. It has highly-rated schools and a small-town community feel, and its downtown is experiencing an exciting revitalization. It’s a perfect choice for people looking for small-town living but who still need convenient access to Dayton metro.

Median home price: $271,250

Amount needed to put 20% down: $54,250

Amount needed to put 10% down: $27,125

Estimated monthly mortgage payment with 20% down: $1,339

Estimated monthly mortgage payment with 10% down: $1,476

If you’re moving to the Dayton area, Oberer Homes can help you find the home that’s right for you. Contact us today to get started!

Share this Post