Purchasing a new home is a huge investment. Understanding home equity from the time of purchase and leveraging it later on is one of the most important financial aspects of owning a home

Home equity can be a safe way to borrow money and pursue new investments, and it helps you to know the potential profit you can make from selling your home at any given time.

So how do you calculate home equity? How do you use it? And what are the best ways to build it? We’ll answer these questions and more in the sections that follow.

Let’s dive in!

Quick Takeaways

- Home equity is the portion of a home’s total value actually possessed by the homeowner.

- You can calculate home equity by finding the difference between your home’s current market value and what you owe on your mortgage.

- A real estate appraisal is the only way to get a totally accurate home equity valuation.

- Homeowners can borrow against their home equity to finance other important life expenses, like education, home renovations, or investments.

- You can build home equity by focusing on paying back your mortgage quickly.

What is home equity?

Most new homes are purchased with a mortgage loan. As the mortgage is paid off, both the homeowner and the lender maintain a financial interest in the home. Home equity is the amount of the home’s total value possessed by the homeowner at any given time. In other words, it is the difference between what is owed on a mortgage and what the home is currently worth.

Equity rises as the homeowner pays down their mortgage and when the home’s value increases on the market. It also rises if the homeowner does renovations that make the home worth more. Conversely, equity falls if the home’s value decreases faster than the homeowner can pay back their mortgage’s principal balance.

It’s important for homeowners to know their home equity value (or at least an estimate of it) to understand how much of their original home investment they actually own.

How to calculate home equity

The only way to know your exact home equity amount is to have your home appraised by a real estate appraiser. But there are ways to estimate your home equity to have a sense of the potential profit you could earn on your home or ways you could leverage your home equity for other financial endeavors.

The best way to estimate your home’s current value is to look at listing prices for similar homes in your neighborhood. Some real estate sites, like Redfin, will even give you an estimate of your home’s market value even when it’s not for sale (just look up your address on the site).

Once you have a sense of your home’s current value, it’s time to calculate equity. Take the total current value of your home, then subtract what you currently owe on your mortgage. The difference is your current home equity amount.

Ways to use home equity

One of the main reasons homeowners should care about home equity is that it can be a tool for other financial endeavors in your life. Borrowing against your home equity is a fairly safe way to pay off other debt or expenses. Banks also view it in a more friendly way compared to other borrowing options (like credit cards).

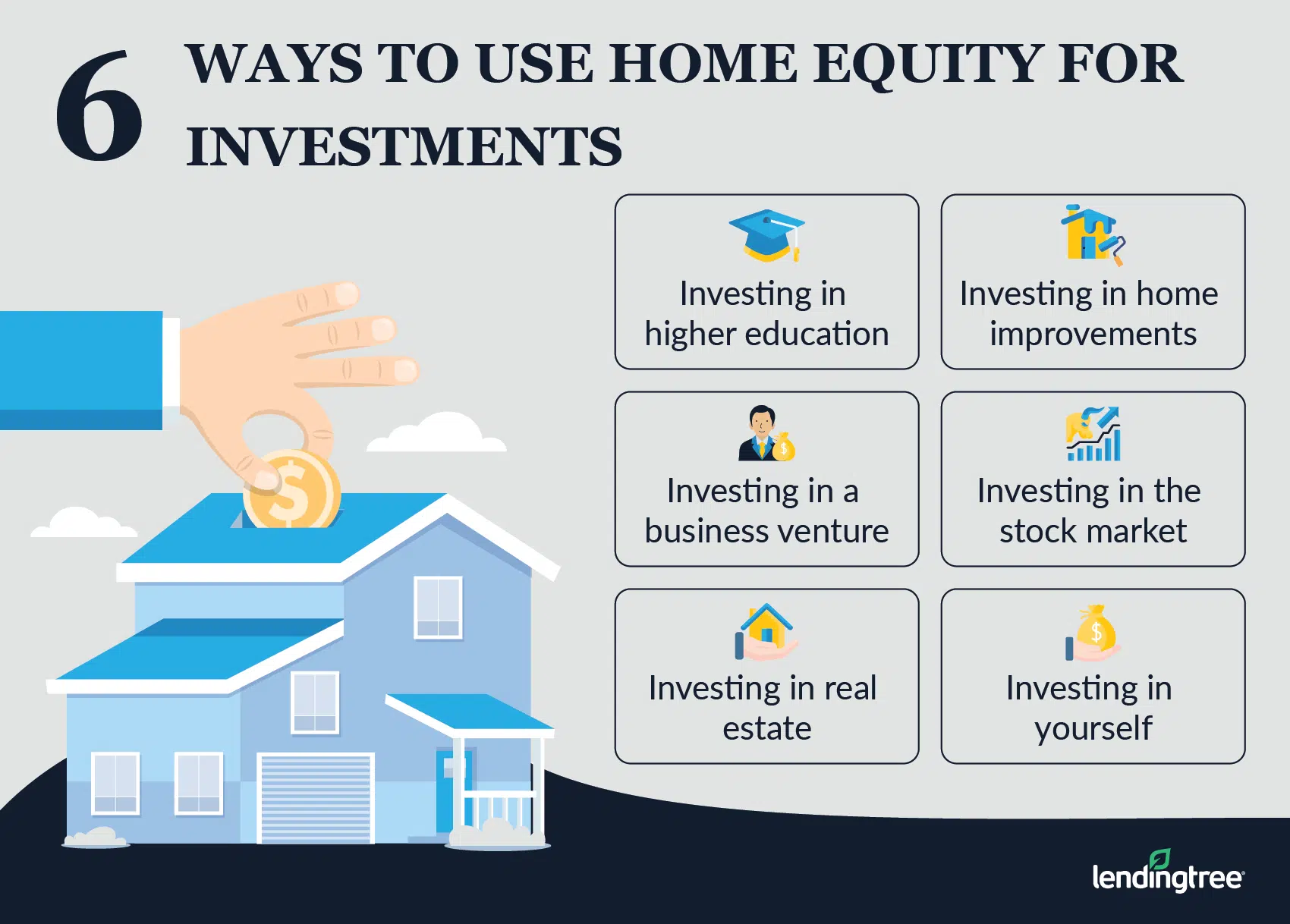

Common ways homeowners leverage their home equity are to:

- Pay for college tuition

- Pay off other debt like student loans or credit cards

- Cover renovations that will increase home value

- Pay for significant life expenses (like a child’s wedding)

- Cover emergency expenses that arise unexpectedly

- Make new investments (like a business venture or the stock market)

You can borrow against your home equity using a few different methods:

- Cash-out refinance – You refinance your home for more than what you currently owe on your mortgage, then receive the difference in cash while maintaining only one mortgage.

- Home equity loan – You borrow a portion of your total home equity as a separate loan from your original mortgage.

- Home equity line of credit – You are approved to spend a certain amount of your total home equity and then pay back only what you spend (like you would with a credit card).

It’s important to note that while all of these options are common, they shouldn’t be pursued without a full assessment of your finances and a plan for repayment. Like any kind of debt, money borrowed against home equity can become unmanageable and negatively impact your financial situation if you’re unable to pay it back as planned.

How to build home equity

So how do you actually build home equity? The most effective strategy is to focus on equity from the start. If you can, make a big down payment when you purchase your new home. This gives you a lower mortgage and higher amount of home equity right away.

Next, focus on repaying your mortgage loan quickly. When you can, pay more than the minimum on your monthly payment to lower your principal balance.

You can also make renovations to increase your home equity, but do your homework before you take this route. Renovations can be expensive, and some have a bigger impact on your home equity than others. It’s important to do your research and even talk to experts to know which renovations are most worthwhile.

If you’re moving to the Dayton area, Oberer Homes can help you find the home that’s right for you. Contact us today to get started!

Share this Post