What is the best way to invest in senior housing? It’s no surprise so many real estate investors (and investors in general) are asking this question right now. The senior housing market is on the rise and the opportunity is big. Increased life expectancy coupled with baby boomers hitting retirement age means demand for senior housing is growing — and will continue to do so in the future.

Modern senior housing options like independent living communities and cohousing facilities are opening doors for traditional real estate investors to get in on the game without worrying about the medical care requirements of assisted living facilities and nursing homes. With the right research and partners, investing in senior housing can be a fruitful decision even for first-time or beginner investors.

In this article, we’ll take a look at why investing in senior housing is such a big opportunity right now as well as three investment options you can consider.

Quick Takeaways

- An increase in life expectancy coupled with baby boomers reaching retirement age has created higher demand than ever for senior housing.

- Senior housing investors should know about the senior care spectrum and how levels of care align with types of housing.

- Real estate investment trusts are a great way to invest in senior housing without having to buy property.

- 55+ or independent living communities are senior housing investment options most similar to traditional real estate investments.

By the numbers: why senior housing is a smart investment

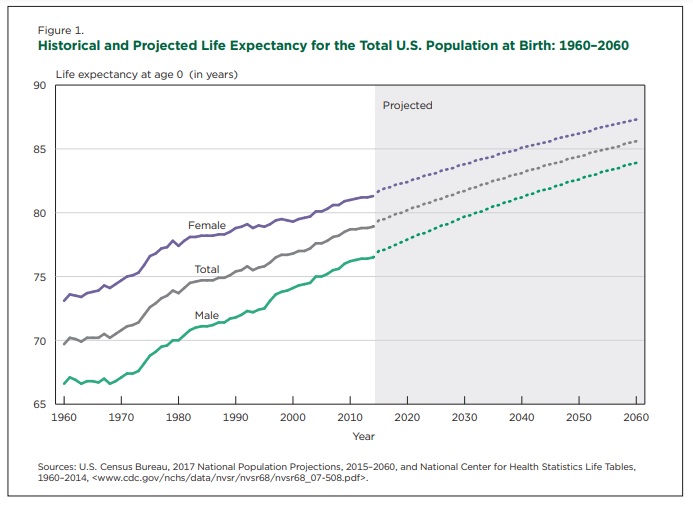

There is a perfect storm of factors making senior housing a smarter investment right now than at any other time in the past. First, average life expectancy is steadily on the rise, and the speed at which it increases is only being made sharper by advancements in healthcare knowledge and technology. Statistics show an even steadier growth trajectory over the next forty years than there has been since the mid-20th century.

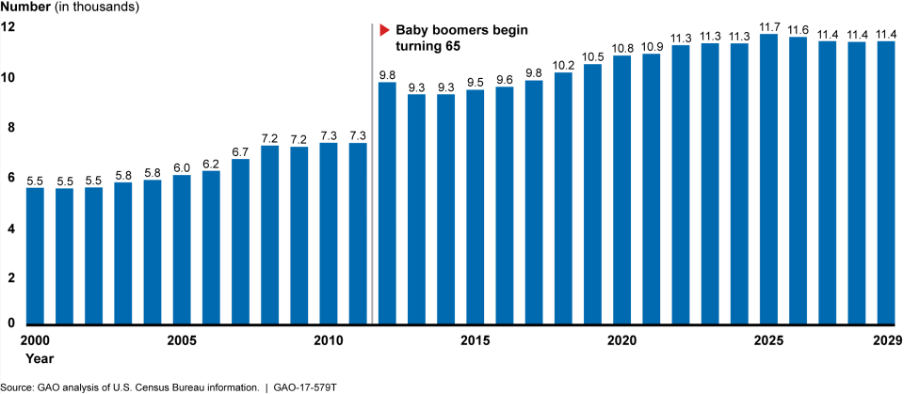

Second, even the youngest baby boomers have now reached their 60s and are starting to retire. The aging of boomers has contributed to a sharp increase in the 65 and older population in the United States. According to the Census Bureau, it’s grown by more than a third (34.2%) over the past 10 years alone. Data from their studies shows the significance of this jump in Americans reaching retirement age.

The 65+ age group made up about 16% of the population in 2020. That number is expected to be closer to a quarter of the entire population by 2050. While 2050 might seem far off, demand for senior housing is only going to increase between now and then.

Considered as a whole, the data tells us that demand for senior housing is higher than ever right now, and will continue to grow for decades to come. And despite these clear and compelling statistics, senior housing investment has still not reached the investment mainstream. Investors who take the leap now are still first movers in this space and will likely reap the biggest benefits.

Need-to-know basics of investing in senior housing

There are unique considerations that you should know if you’re considering investing in senior housing. First of these is the senior living spectrum, which shows the level of supervision and care required vs. cost for various housing options.

Here’s one commonly used visual version of the spectrum:

For senior housing investors, the spectrum is useful for understanding two factors: the revenue earned by a particular type of senior housing and the overall level of medical care (and thus potential responsibility of the investor) required by its residents.

Second, it’s important to understand the way that senior housing is managed and what your role will be as an investor. In addition to its status as a real estate asset class, senior housing communities and facilities are operating businesses that require official operators.

Because senior housing is a highly regulated industry, operators need specific experience and knowledge in order to safely and successfully manage properties. Operator effectiveness plays a critical role in the ultimate success of the investment.

Finally, senior housing investors should understand a few specific demographics before choosing a location and/or investment property. Most notably, investors should understand the size of the senior population in a particular area, their median household income, the income of adult children in the area (people in their 30s, 40s, and 50s handling care for senior parents), and the area’s overall housing values.

4 of the best ways to invest in senior housing

Now that we’ve covered the opportunity landscape for senior housing investment, let’s dive into the actual investment options.

Real Estate Investment Trusts

A real estate investment trust (REIT) is a company that owns (and usually operates) income producing real estate. There are several REITs that invest specifically in senior housing. REITs are one of the lowest-risk options for people who want to invest in senior housing. None of the actual property management or risk falls onto REIT investors because it’s handled by the trust.

That said, every investment fund comes with risk, the level of which depends on the fund itself. If you think REITs might be the way you want to go, check out 5 of the top senior living REITs you can choose from.

Rent commercial property to third-party operator

This is the middle-of-the-road option for investors who want to add senior housing to their portfolio and own the property, but also want to reduce risk by passing off operations to a third party. Investors taking this route can either purchase an existing senior housing property or purchase a qualifying commercial property and convert it. Either way, this option allows the investor to collect passive rent income without having to handle the day-to-day responsibility of operating the business.

Independently own and operate

In many cases, owning and operating a senior living facility yourself can be the most lucrative option. That said, it requires deep knowledge, experience, and understanding of the rules and regulations in the industry as well as medical care requirements for residents. It also involves a much higher level of risk. This option is more than just an investment, it’s a full time business responsibility.

55+ or independent living communities

Investing in 55+ or independent living communities is much more similar to a regular real estate investment. Because seniors living in these communities generally require no or low levels of support care, investors who purchase or develop these types of properties have minimal risk of liability or responsibility for managing medical support services and on-site care. This is a great option for residential real estate investors who want to get in on the senior housing opportunity without veering too far from their traditional real estate experience.

If you’re moving to the Dayton area, Oberer Homes can help you find the home that’s right for you. Contact us today to get started!

Share this Post